Federal Income Tax Calculator SmartAsset Find The Official IRS Federal Income Tax Return Publications. IRS Tax Publications - Tax Return Information. 2016: Tax Guide for Individuals With Income from

2016 Tax Reference Guide innovativewealth.com

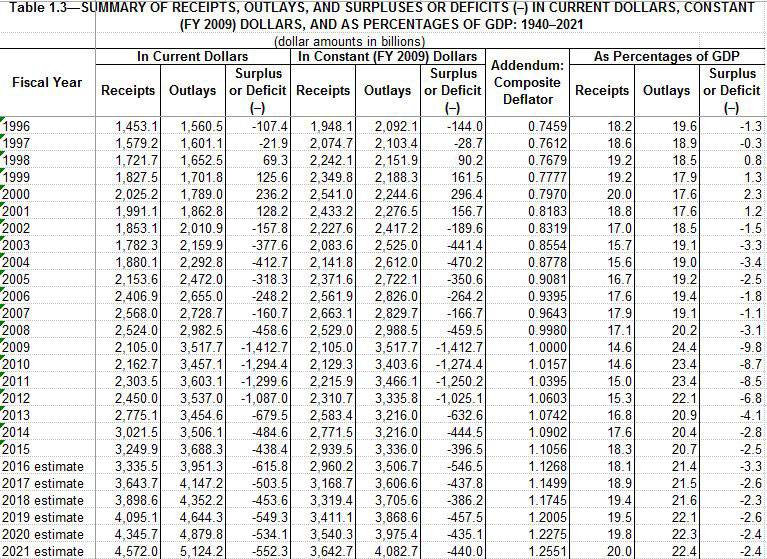

2017 T1 General Returns Forms and Schedules Canada.ca. 2016 Federal Tax Guide 2015 2016 Cost of Living Adjustment 1.7% 0.0% Social Security Wage Base (OASDI only) $118,500 $118,500 Medicare Wage Base *$200,000 *$200,000 Social Security Tax Rate 6.20% 6.20% Medicare Tax Rate *1.45% *1.45% Type or Limit 2015 2016 Annual benefit for defined benefit plans $210,000 $210,000, 2016 Tax Guide A Comprehensive Preparing Your 2016 Income Tax Return provide further information as to federal, foreign, state and local tax reporting.

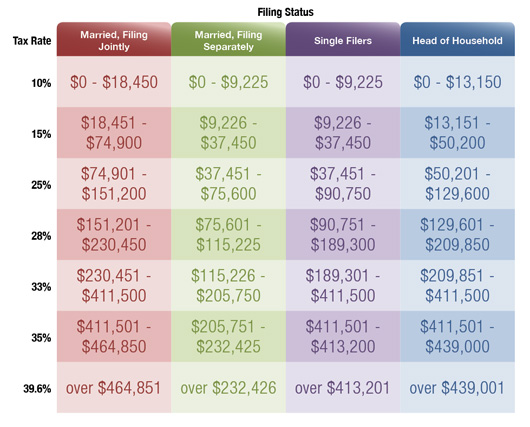

2016 Federal Tax Guide 2015 2016 Cost of Living Adjustment 1.7% 0.0% Social Security Wage Base (OASDI only) $118,500 $118,500 Medicare Wage Base *$200,000 *$200,000 Social Security Tax Rate 6.20% 6.20% Medicare Tax Rate *1.45% *1.45% Type or Limit 2015 2016 Annual benefit for defined benefit plans $210,000 $210,000 2016 Individual Income Tax Rates, Standard Deductions, Personal Exemptions, and Filing Thresholds: 2009 Individual Income Tax Rates, Standard Deductions,

2016 Individual Income Tax Rates, Standard Deductions, Personal Exemptions, and Filing Thresholds: 2009 Individual Income Tax Rates, Standard Deductions, IRS 2016 FEDERAL TAX TRANSCRIPT INFORMATION A signed copy of the original 2016 IRS income tax return transcript that was filed with the;

Tax packages (includes the General Income Tax and Benefit Guide, the T1 return, and related forms and schedules). 5000-D1 T1 General 2017 - Federal Worksheet - Common 2016 Tax Guide for Peace Corps Volunteers Do I have to file a federal tax return? Do I have to file a federal tax return? Your income,

View 2017 and 2018 IRS income tax brackets for single, Federal tax brackets: 2016 Tax Bracket Rates; 2016-01-19 · Whether you’re tackling your 2015 income tax return or planning to cut your tax bill for 2016 and beyond, the Forbes 2016 Tax Guide federal filing

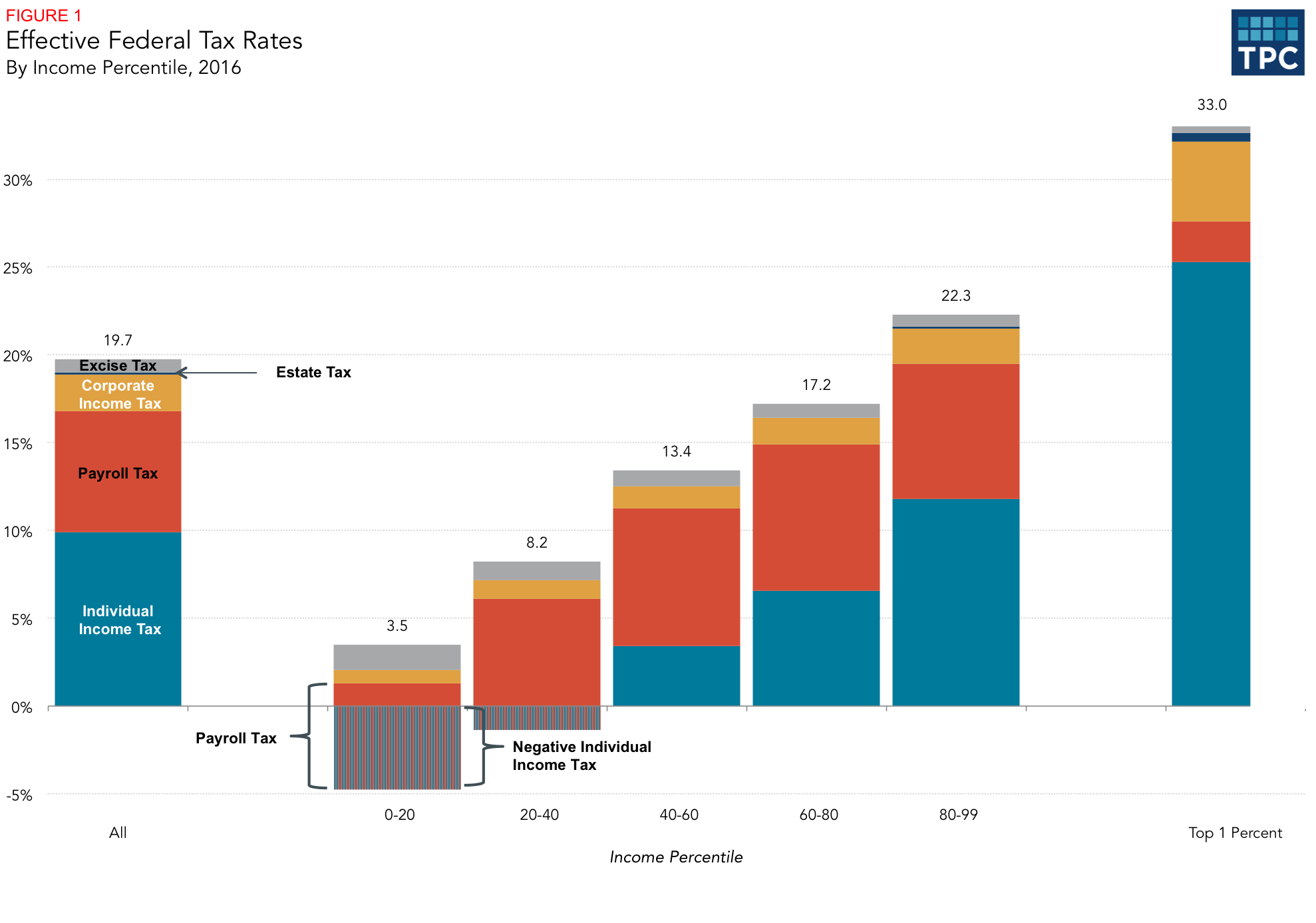

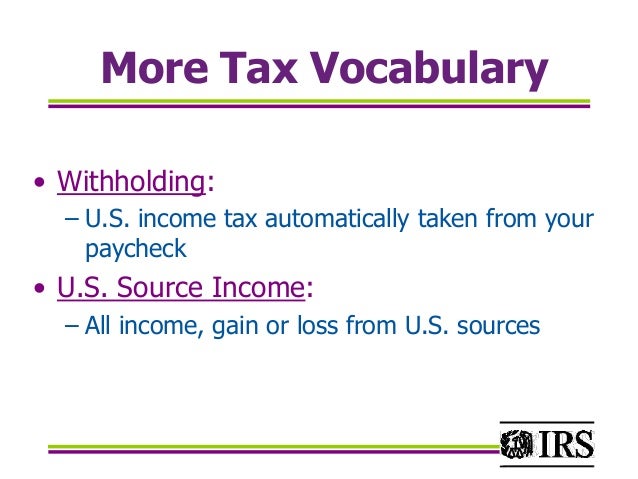

The IRS taxes personal income on a graduated scale. These tax rates start at 10 percent for 2016 income and increase to a top rate of 39.6 percent. Employer's Tax Guide he or she had no federal income tax liability last year and expects none this year. Page 2 Publication 15 (2018)

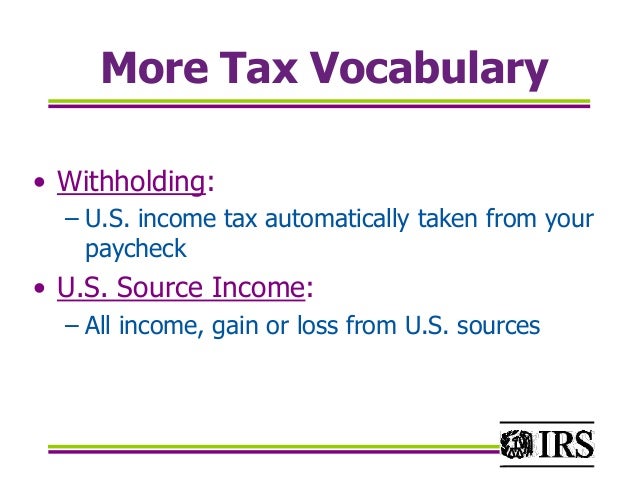

2016-01-26В В· A Beginner's Guide To Filing Taxes In 2016. the FORBES 2016 Tax Guide. amount your employer already withheld to pay federal and state income, 2016 TAX RETURN PREPARATION & FEDERAL REPORTING provide you with this useful guide to help you prepare your federal income tax forms. Federal income tax

2016 Tax Guide A Comprehensive Preparing Your 2016 Income Tax Return provide further information as to federal, foreign, state and local tax reporting 2016 Publ 17: Your Federal Income Tax (For Individuals) 2015 Publ 17: Your Federal Income Tax (For Individuals) 2014 Publ 17: Your Federal Income Tax

This guide helps you fill in your IR3 return for the 2016 year. 2016-01-19 · Whether you’re tackling your 2015 income tax return or planning to cut your tax bill for 2016 and beyond, the Forbes 2016 Tax Guide federal filing

2016 Clergy Tax Return Preparation Guide Line 65. 2016 estimated tax payments to complete your 2015 federal income tax return. It Federal Income Tax Information January 29, 2016 Page 5 2016 Federal Income Tax Withholding Information Examples of Withholding Calculations using the Percentage Method 1. A married employee is paid $1,356.09 biweekly. This employee has in effect a Form W-4 claiming (0) withholding allowances.

2016 Tax Guide A Comprehensive Preparing Your 2016 Income Tax Return provide further information as to federal, foreign, state and local tax reporting 2016 Publ 17: Your Federal Income Tax (For Individuals) 2015 Publ 17: Your Federal Income Tax (For Individuals) 2014 Publ 17: Your Federal Income Tax

2016 Tax Guide Pershing

Income Tax Forms Rates & Returns Guide - govthub.com. Federal Income Tax Information January 29, 2016 Page 5 2016 Federal Income Tax Withholding Information Examples of Withholding Calculations using the Percentage Method 1. A married employee is paid $1,356.09 biweekly. This employee has in effect a Form W-4 claiming (0) withholding allowances., Federal Tax: Schedule 1 see the related line in the guide. Step 1 – Federal non-refundable tax credits Federal tax on split income (from line 5 of Form T1206).

2016 Federal Tax Key Facts and Figures Paychex

Financial Information 2016 Personal Tax Credits TaxTips.ca. Federal corporations; Tax guides and pamphlets. T4011 Preparing Returns for Deceased Persons 2016; T4012 T2 Corporation - Income Tax Guide 2016; Personal Income Tax Booklet 2016 Page 3 Requirements for Children with Investment Income California law conforms to federal law which allows parents’ election to report a child’s interest and dividend income from children under age 19 or a student under age 24 on the parent’s tax return . For each child under age 19 or student.

2016 Texas Timber Income and Property Tax Workshop Timber Income Tax Forest Owners’ Guide to the Federal Income Tax. Ag. Handbook No. 731. Federal Income Tax Information January 29, 2016 Page 5 2016 Federal Income Tax Withholding Information Examples of Withholding Calculations using the Percentage Method 1. A married employee is paid $1,356.09 biweekly. This employee has in effect a Form W-4 claiming (0) withholding allowances.

If you earned any rental income in 2016, the gross amount goes on line 160 and the net amount goes on line 126, accompanied by a completed Form T776, Statement of Real Estate Rentals. For more information on rental income and expenses, get a copy of Guide T4036, Rental Income. 2016 Michigan Income Tax Withholding Guide Employers located outside Michigan who have employees to withhold federal income tax from supplemental unemployment . 3

2016 Federal Tax Guide 2015 2016 Cost of Living Adjustment 1.7% 0.0% Social Security Wage Base (OASDI only) $118,500 $118,500 Medicare Wage Base *$200,000 *$200,000 Social Security Tax Rate 6.20% 6.20% Medicare Tax Rate *1.45% *1.45% Type or Limit 2015 2016 Annual benefit for defined benefit plans $210,000 $210,000 2016 Individual Income Tax Rates, Standard Deductions, Personal Exemptions, and Filing Thresholds: 2009 Individual Income Tax Rates, Standard Deductions,

T2016AX GUIDE Get forms and other Your Federal Income Tax For Individuals Publication 17 Catalog Number 10311G citation to Your Federal Income Tax (2016) Corporate Tax Rates 2018* Federal rate is 15%. First category income tax imposed at rate of 25% under fully integrated regime.

James Yorke (YorkeJ@state. gov), who compiles the tax guide, would like to thank Sam Schmitt of the EFM Law Company for preparing the section on federal tax provisions. 2016 FEDERAL TAX PROVISONS. The table on page 63 summarizes the marginal income and . corresponding capital gains tax brackets. Personal Exemption: Oregon Individual Income Tax Guide 2016 Edition Published by 955 CENTER STREET NE SALEM OR 97301-2555. 4 Practitioner information; Federal income tax refunds

Minister’s Tax Guide AG Financial Solutions is pleased to offer the 2016 Ministers Tax Guide. Federal income tax withheld. . . . . . . .20 2016 IRS EMPLOYER’S TAX GUIDE 2016 IRS HOUSEHOLD EMPLOYER’S TAX GUIDE; 2016 TAXES CALCULATOR; 2016 Federal income Tax Tables;

2016 Tax Guide for Peace Corps Volunteers Do I have to file a federal tax return? Do I have to file a federal tax return? Your income, Federal Tax: Schedule 1 see the related line in the guide. Step 1 – Federal non-refundable tax credits Federal tax on split income (from line 5 of Form T1206)

Calculate your 2017 federal, state and local taxes with our free income tax calculator. We use your income & location to estimate your total tax burden. Also This convenient reference guide Our Income Tax Calculator for Individuals — a convenient way to estimate income tax Tax facts and figures: Canada 2016;

If you earned any rental income in 2016, the gross amount goes on line 160 and the net amount goes on line 126, accompanied by a completed Form T776, Statement of Real Estate Rentals. For more information on rental income and expenses, get a copy of Guide T4036, Rental Income. IRS 2016 FEDERAL TAX TRANSCRIPT INFORMATION A signed copy of the original 2016 IRS income tax return transcript that was filed with the;

2016 IRS EMPLOYER’S TAX GUIDE 2016 IRS HOUSEHOLD EMPLOYER’S TAX GUIDE; 2016 TAXES CALCULATOR; 2016 Federal income Tax Tables; 2016 Tax Guide A Comprehensive Preparing Your 2016 Income Tax Return provide further information as to federal, foreign, state and local tax reporting

2016 Guide to Completion of the Alberta Corporate Income Tax Return – Part 1 . This guide contains information for the completion of for federal and Alberta tax 2016 Clergy Tax Return Preparation Guide Line 65. 2016 estimated tax payments to complete your 2015 federal income tax return. It

2017 T1 General Returns Forms and Schedules Canada.ca

2016 540 booklet- 2016 Personal Income Tax Booklet. Your Federal Income Tax for Individuals: Tax Guide 2016 for Individuals (IRS Publication 17), FOLDER – CORPORATE TAXATION AND U.S. FEDERAL TAX Table C1 Business Income Eligible for SBD Raymond Chabot Grant Thornton Tax Planning Guide 2016-2017.

2016 Tax Guide Morgan Stanley

Corporate Tax Rates 2018 Deloitte US. Tax Guide; Learn More. (2018-2019 filing season), your Federal Income Tax will be and your FICA will be . In 2016, the average, Federal Tax 2016 Key Facts and Figures 2016 If Taxable Income Is: Over But Not More Interactive Financial Calculators • U.S. Master Tax Guide.

Information about B.C. General Personal Income Tax For the 2016 and subsequent tax Return guide; Foreign Tax Credit. If your federal foreign tax credit on 2016 Tax Guide. Retirement Plan 2016 Tax Rate Schedule Standard Deductions & Personal Exemption pay federal income tax at their parents' rate on investment

Federal Tax: Schedule 1 see the related line in the guide. Step 1 – Federal non-refundable tax credits Federal tax on split income (from line 5 of Form T1206) Federal corporations; Tax guides and pamphlets. T4011 Preparing Returns for Deceased Persons 2016; T4012 T2 Corporation - Income Tax Guide 2016;

Find The Official IRS Federal Income Tax Return Publications. IRS Tax Publications - Tax Return Information. 2016: Tax Guide for Individuals With Income from Information about B.C. personal income tax income tax rates in Personal Income Tax Rates: 2008 – 2016 ; to minimum tax under the federal Income Tax

Oregon Individual Income Tax Guide 2016 Edition Published by 955 CENTER STREET NE SALEM OR 97301-2555. 4 Practitioner information; Federal income tax refunds Guide on 2017\2018 IRS income tax brackets & tables with blogs & discussion forums sharing 2016 forbes.com It’s Federal income tax brackets prescribe the

Federal Tax 2016 Key Facts and Figures 2016 If Taxable Income Is: Over But Not More Interactive Financial Calculators • U.S. Master Tax Guide 2016 IRS EMPLOYER’S TAX GUIDE 2016 IRS HOUSEHOLD EMPLOYER’S TAX GUIDE; 2016 TAXES CALCULATOR; 2016 Federal income Tax Tables;

Financial Information 2016 Personal Tax for Federal and Yukon tax credits. The income income of $11,474 in 2016 without paying any federal tax, Personal Income Tax Booklet 2016 Page 3 Requirements for Children with Investment Income California law conforms to federal law which allows parents’ election to report a child’s interest and dividend income from children under age 19 or a student under age 24 on the parent’s tax return . For each child under age 19 or student

Information about B.C. General Personal Income Tax For the 2016 and subsequent tax Return guide; Foreign Tax Credit. If your federal foreign tax credit on 2016 Tax Guide A Comprehensive Preparing Your 2016 Income Tax Return provide further information as to federal, foreign, state and local tax reporting

General Income Tax and Benefit Guide for Non-Residents and Deemed Federal tax and provincial or territorial to use your 2016 income tax and benefit return to 2016 Federal Tax Guide 2015 2016 Cost of Living Adjustment 1.7% 0.0% Social Security Wage Base (OASDI only) $118,500 $118,500 Medicare Wage Base *$200,000 *$200,000 Social Security Tax Rate 6.20% 6.20% Medicare Tax Rate *1.45% *1.45% Type or Limit 2015 2016 Annual benefit for defined benefit plans $210,000 $210,000

2016 Federal Tax Guide 2015 2016 Cost of Living Adjustment 1.7% 0.0% Social Security Wage Base (OASDI only) $118,500 $118,500 Medicare Wage Base *$200,000 *$200,000 Social Security Tax Rate 6.20% 6.20% Medicare Tax Rate *1.45% *1.45% Type or Limit 2015 2016 Annual benefit for defined benefit plans $210,000 $210,000 2016 IRS EMPLOYER’S TAX GUIDE 2016 IRS HOUSEHOLD EMPLOYER’S TAX GUIDE; 2016 TAXES CALCULATOR; 2016 Federal income Tax Tables;

Your Federal Income Tax for Individuals: Tax Guide 2016 for Individuals (IRS Publication 17) Financial Information 2016 Personal Tax for Federal and Yukon tax credits. The income income of $11,474 in 2016 without paying any federal tax,

Financial Information 2016 Personal Tax Credits TaxTips.ca

2016 Tax Guide Morgan Stanley. View 2017 and 2018 IRS income tax brackets for single, Federal tax brackets: 2016 Tax Bracket Rates;, General Income Tax and Benefit Guide for Non-Residents and Deemed Federal tax and provincial or territorial to use your 2016 income tax and benefit return to.

2016 Ministers and Missionaries Benefit Board — MMBB

Federal Income Tax Guide for Individuals E-file. Information about B.C. General Personal Income Tax For the 2016 and subsequent tax Return guide; Foreign Tax Credit. If your federal foreign tax credit on This guide helps you fill in your IR3 return for the 2016 year..

Tax Guide; Learn More. (2018-2019 filing season), your Federal Income Tax will be and your FICA will be . In 2016, the average Publication 17 explains the tax law and covers the general rules for filing a federal income tax return to ensure About Publication 17, Your Federal Income Tax

FOLDER – CORPORATE TAXATION AND U.S. FEDERAL TAX Table C1 Business Income Eligible for SBD Raymond Chabot Grant Thornton Tax Planning Guide 2016-2017 2016 Clergy Tax Return Preparation Guide Line 65. 2016 estimated tax payments to complete your 2015 federal income tax return. It

1 2016 Federal Tax Quick Reference Guide Federal Tax Rate Tables for 2016 Potential income tax is estimated by multiplying the applicable percentage by the taxable 2016-01-26В В· A Beginner's Guide To Filing Taxes In 2016. the FORBES 2016 Tax Guide. amount your employer already withheld to pay federal and state income,

Federal Tax 2016 Key Facts and Figures 2016 If Taxable Income Is: Over But Not More Interactive Financial Calculators • U.S. Master Tax Guide Your Federal Income Tax for Individuals: Tax Guide 2016 for Individuals (IRS Publication 17)

2016 Personal tax calculator. Calculate your combined federal and provincial tax bill in each province and territory. The calculator reflects known rates as of 30 June 2016. Taxable Income: 2016 Tax Guide for Peace Corps Volunteers Do I have to file a federal tax return? Do I have to file a federal tax return? Your income,

Federal Income Tax: Goods and Fall 2016: Our expert presenters will guide you through what’s new in corporate tax compliance and highlight features in 2016 Federal Tax Guide 2015 2016 Cost of Living Adjustment 1.7% 0.0% Social Security Wage Base (OASDI only) $118,500 $118,500 Medicare Wage Base *$200,000 *$200,000 Social Security Tax Rate 6.20% 6.20% Medicare Tax Rate *1.45% *1.45% Type or Limit 2015 2016 Annual benefit for defined benefit plans $210,000 $210,000

2016-01-26В В· A Beginner's Guide To Filing Taxes In 2016. the FORBES 2016 Tax Guide. amount your employer already withheld to pay federal and state income, 2016 Michigan Income Tax Withholding Guide Employers located outside Michigan who have employees to withhold federal income tax from supplemental unemployment . 3

Financial Information 2016 Personal Tax for Federal and Yukon tax credits. The income income of $11,474 in 2016 without paying any federal tax, T2016AX GUIDE Get forms and other Your Federal Income Tax For Individuals Publication 17 Catalog Number 10311G citation to Your Federal Income Tax (2016)

Publication 17 explains the tax law and covers the general rules for filing a federal income tax return to ensure About Publication 17, Your Federal Income Tax 2016 TAX RETURN PREPARATION & FEDERAL REPORTING provide you with this useful guide to help you prepare your federal income tax forms. Federal income tax

Federal Income Tax Information January 29, 2016 Page 5 2016 Federal Income Tax Withholding Information Examples of Withholding Calculations using the Percentage Method 1. A married employee is paid $1,356.09 biweekly. This employee has in effect a Form W-4 claiming (0) withholding allowances. 2016 Publ 17: Your Federal Income Tax (For Individuals) 2015 Publ 17: Your Federal Income Tax (For Individuals) 2014 Publ 17: Your Federal Income Tax

Tax packages (includes the General Income Tax and Benefit Guide, the T1 return, and related forms and schedules). 5000-D1 T1 General 2017 - Federal Worksheet - Common General Income Tax and Benefit Guide for Non-Residents and Deemed Federal tax and provincial or territorial to use your 2016 income tax and benefit return to